Digital Markets Act and Mobile Apps: What is changing?

The Digital Markets Act, a European legislation aimed at regulating the activities of major companies in the digital sector, will come into effect on March 6, 2024. Its arrival marks a significant regulatory milestone, requiring digital players to comply with new rules. This development will also affect mobile advertisers, compelling them to anticipate these changes. Everyone must adapt to meet the requirements imposed by the Digital Markets Act.

What is the Digital Markets Act?

The main objective of the Digital Markets Act is to combat anti-competitive practices of major companies in the digital sector and address imbalances in their dominance over the European digital market by:

- Promoting a fair competitive environment among digital players, especially to support small and medium-sized enterprises as well as European startups facing significant challenges in establishing themselves.

- Encouraging innovation, growth, and competitiveness.

- Ensuring consumer protection by strengthening their freedom of choice.

Gatekeepers, the main entities targeted by the DMA

The Digital Markets Act specifically targets “gatekeepers” who are identified according to 3 main criteria:

- Provide one or more essential platform services in at least three European countries.

- Have a very high revenue or market valuation: at least €7.5 billion in annual revenue in Europe over the last three years or a market capitalization of €75 billion or more in the last year.

- Have a large user base in the EU: more than 45 million Europeans per month and 10,000 professionals per year over the last three years.

These companies, such as the GAFAM (Google, Apple, Facebook, Amazon, Microsoft), create user dependency on their ecosystem by offering a diverse range of services deemed essential. This complicates competition for other companies, struggling to compete with the completeness and user-friendliness offered, while also limiting users’ freedom to leave the platform. This strategy reinforces the gatekeepers’ quasi-monopolistic position on the European market, significantly reducing the space available for other competitors.

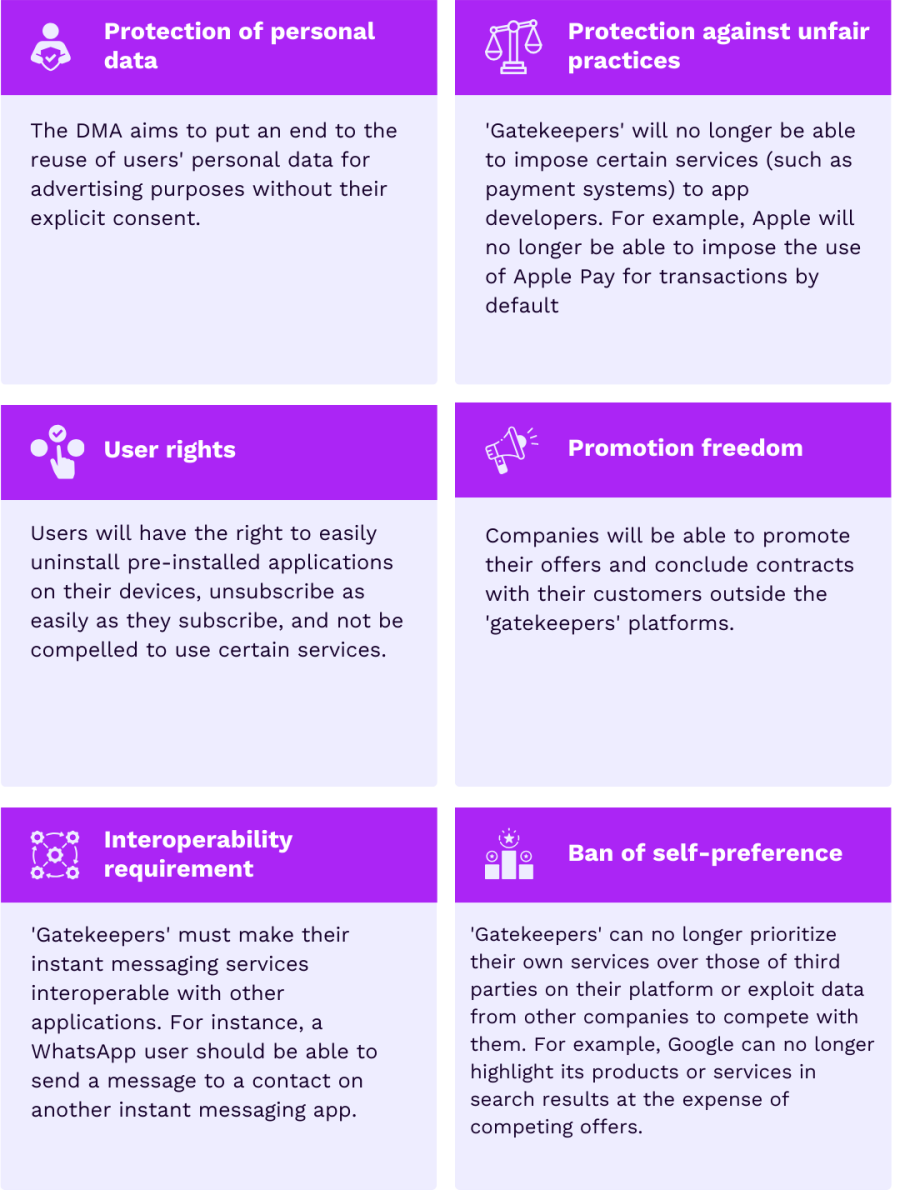

What are the changes imposed by the Digital Markets Act?

Companies affected by the Digital Markets Act are required to respect a number of rules and prohibitions and must adhere to these new rules by March 6, 2024, under penalty of fines. Here are some of the aspects covered by these measures:

How are distribution channels for performance-based mobile advertising adapting?

Meta: Changes focused on the user

Meta has implemented various measures to meet Digital Markets Act requirements. These changes primarily focus on the user by providing increased control over the sharing of information across its different services. This is particularly evident on Facebook and Instagram, where users will have the choice of whether or not to share their account data between the two platforms, an option extended to other services such as Messenger, Marketplace, Gaming and Ads.

To meet the interoperability requirement, another significant measure announced by Meta is the ability to use Messenger without needing a Facebook profile. Users can access the messaging app’s features without providing information to Facebook when creating a Messenger account. The question persists for Meta’s latest product, Threads. While Instagram and Threads accounts were initially linked, requiring the deletion of the Instagram account to remove the Threads account, this situation could change with the Digital Markets Act. However, Meta has not officially communicated on this matter yet.

Apple: Uncertain Proposals Challenged by the Industry

Apple also announced various changes, including the authorization of third-party app stores.

Developers will be able to offer their apps outside the App Store, subject to approval by Apple. Direct downloads from other unauthorized apps or websites will still be subject to checks.

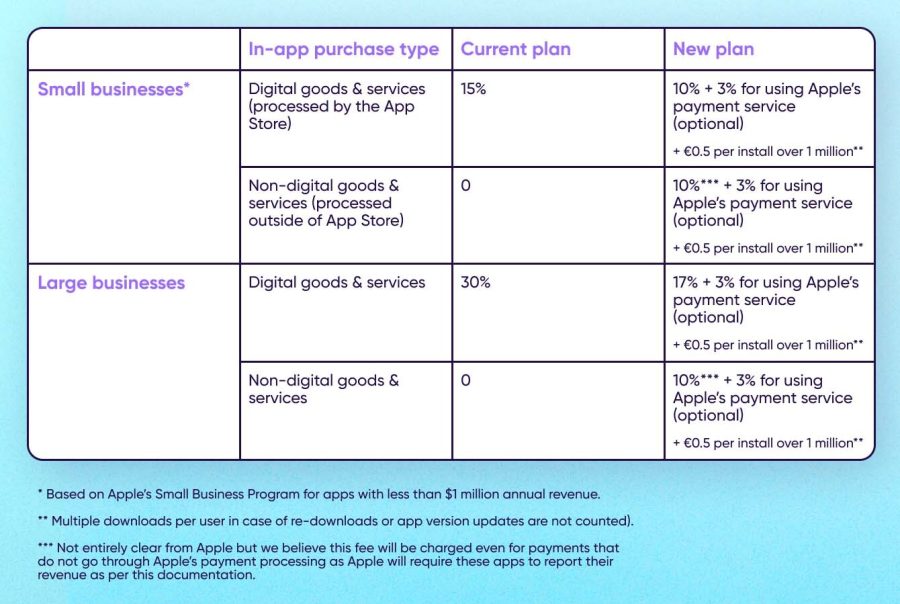

Furthermore, these changes announced by Apple to comply with the DMA will come with new fees for distribution outside the App Store.

For developers wishing to distribute their applications outside the App Store, additional fees will now apply. It is essential to carefully examine the financial impacts of these changes, as it is not certain that a reversal is possible. Apple also offers a fee calculation tool to assist app distributors in making their estimates.

However, the proposals put forth by Apple have been poorly received by many players in the digital sector, with 34 (including Spotify, Deezer, and Epic Games) signing a letter addressed to the European Commission on March 1, 2024, to denounce the measures announced by the company.

They argue that the new fee structure proposed by Apple is complex and confusing, encouraging developers to prefer the old model. This is particularly criticized due to the Core Technology Fee, which imposes a €0.50 tax for each annual installation beyond the first million. This approach appears to contradict the Digital Markets Act and allows Apple to maintain its dominant position, thereby hindering competition.

The changes announced by Google: real and tangible impacts on user acquisition

2 new fields in the consent form

Google was among the first to announce changes implemented to comply with the Digital Markets Act requirements. Several associated services such as the search engine, YouTube, and Google Maps will be affected. The aim is to create more space for other companies, such as travel comparison platforms. In search results, these platforms will be more prominently featured compared to Google Flights for example.

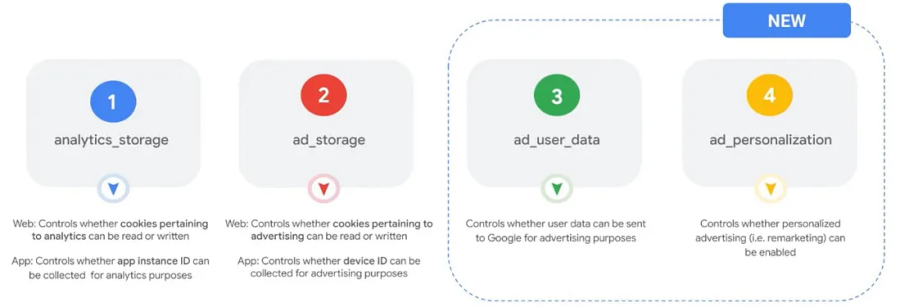

These changes also focus on updating their user consent policy, placing a specific emphasis on transparency in the use of user data. For advertisers running acquisition campaigns, this entails an update from Consent Mode to Consent Mode V2. This new model means that for each installation, event, or information related to a user from the European Economic Area (EEA) used for an audience, Google plans to add two new fields in its consent request:

- ad_user_data: This field defines consent for sending user data to Google for advertising purposes.

- ad_personalization: This field specifies consent for personalized advertising (e.g., for remarketing).

Make sure to update CMP, MMP, and Firebase to fully leverage Google user data

Even though the changes proposed by Apple and Meta have not yet materialized for advertisers, those announced by Google can already be considered to prepare for the Consent Mode V2.

For advertisers managing Google campaigns (Google Ads and Google Marketing Platform) in the EEA, it is essential to get ready now:

- Use a certified Google Consent Management Platform (CMP). A list including options such as Didomi, OneTrust, or Cookie Bot is available on Google’s support page.

- Update your CMP to ensure compliance with Google’s latest requirements for DMA and its ability to incorporate the two consent fields mentioned earlier (ad_personalization and ad_user_data).

- Make sure your MMP is up to date to receive the two new tags from the CMP.

- If you are using Firebase, make sure you have the latest version of the SDK.

Not complying with consent mode V2, and therefore not sending this consent information to Google, can impact advertisers’ ability to measure the performance of their Google campaigns targeting the EEA. In addition, it could limit their ability to leverage their users’ data through Google’s audience solutions, such as Firebase.

Author: Rayan Sarkis, Senior UA Manager @Addict Mobile

NEWS

Article in relation

UA: How GenAI helps us diversify our creative…

-5% CPI, +23 points ROAS, GenAI creatives are increasingly becoming a performance driver for apps. When combined with a traditional approach, they allow...

Published on 8 July 2024

Interview with Chloé Morant, Senior UA Manager and…

Meet Chloé, Senior UA Manager and ASO Team Leader at Addict Mobile. She joined in 2021 as a UA Manager and is now...

Published on 11 June 2024

Our 4 Tips for UA Creatives That Convert

We cannot emphasize enough: creativity is crucial for the success of user acquisition campaigns. It’s an essential element that can greatly impact performance...

Published on 20 May 2024