Acquisition Battle #2: iOS Vs Android

iOS and Android dominate the mobile market, but when it comes to user acquisition, their ecosystems are anything but equivalent.

On one side, iOS offers a structured environment focused on user quality, but one that’s shaped by strict rules around tracking and ad delivery. On the other, Android is more flexible, built around scale, test-and-learn strategies, and broader activation.

So, iOS vs Android, what are the strengths and limitations of each OS? Let the battle begin.

Key Takeaways

- Data: iOS is limited by ATT and SKAN, Android is still transparent and granular (though Privacy Sandbox may tighten signals).

- Markets: iOS dominates premium regions (US, Japan, Northern Europe), Android leads in high-growth markets (India, LATAM, SEA).

- Costs & Revenue: Higher CPI on iOS but stronger ARPU and in-app spend. Android offers lower CPIs and strong potential in emerging markets.

- ASO: iOS = stricter framework with CPP as a strength, Android = more flexible with fast testing but more volatile.

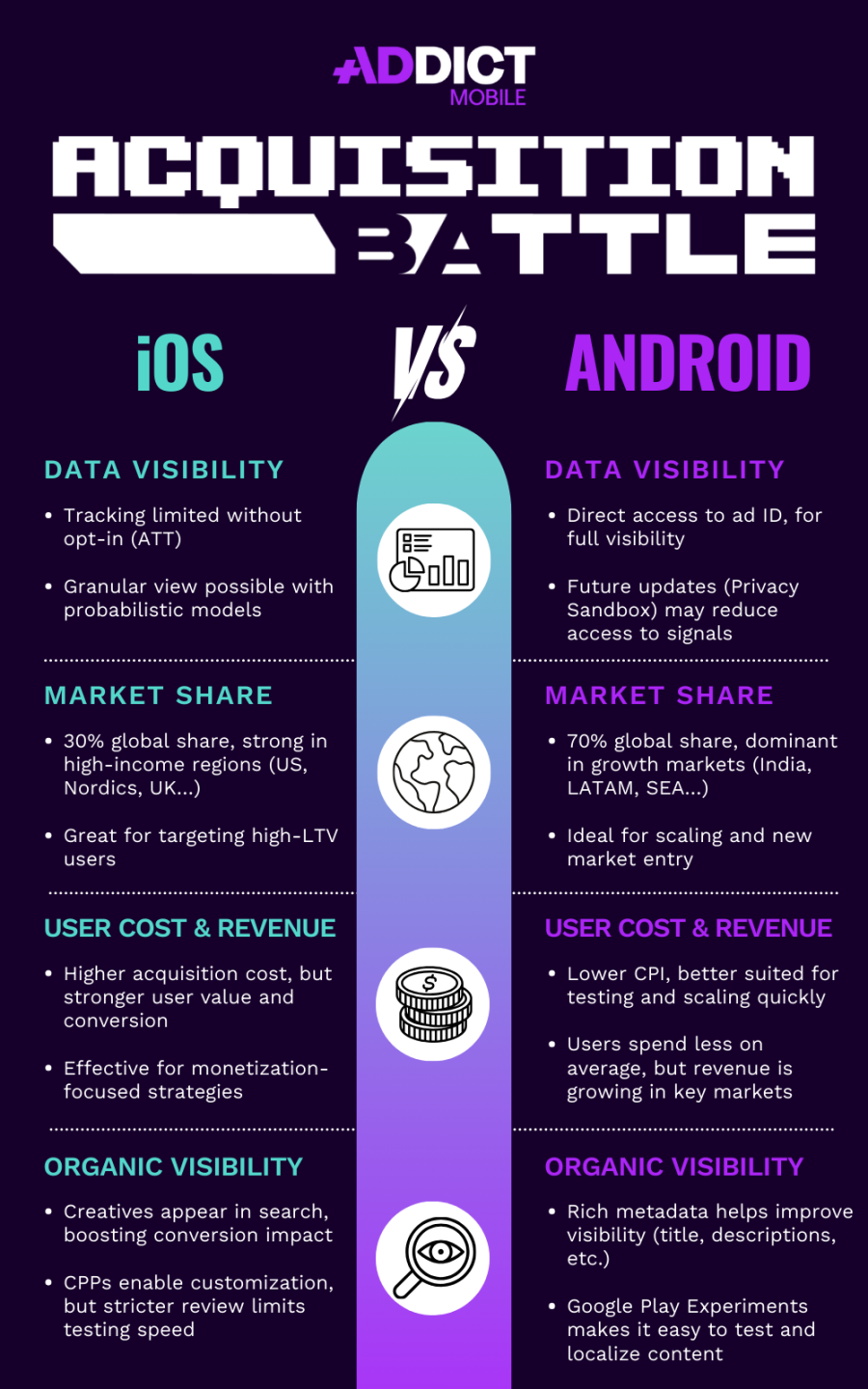

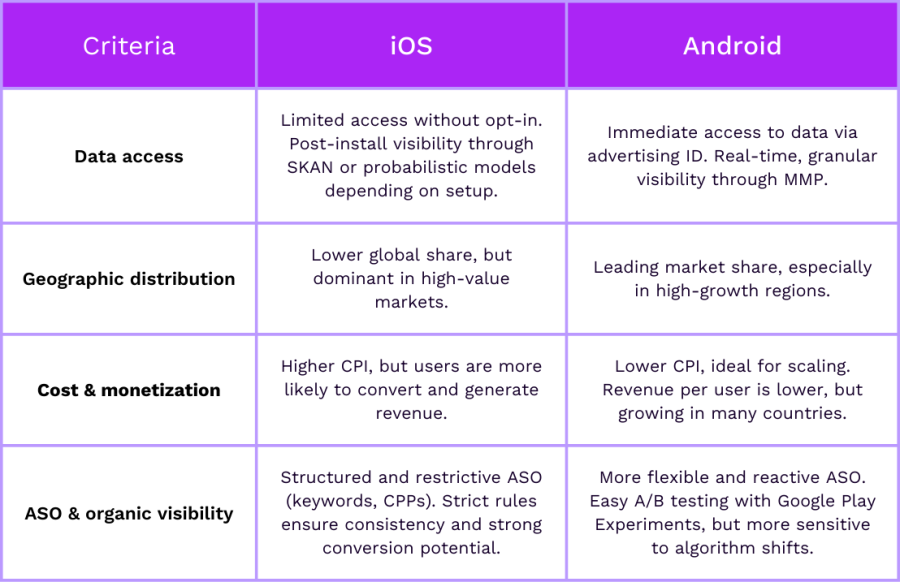

Round 1: Data Visibility

iOS

With the rollout of ATT, access to data on iOS has become much more limited. Without user opt-in, advertisers can’t use the IDFA and have to rely on two main alternatives:

- SKAdNetwork, Apple’s solution, delivers delayed postbacks (24–48h), anonymized data, and very limited insights at the user level. Post-install visibility is minimal and hard to exploit for optimization.

- Probabilistic models help rebuild a more detailed post-install view. They provide granular data in real time, with flexible attribution windows managed through MMPs. Their accuracy depends on signal quality, but when well set up, they offer a strong alternative for tracking and optimizing performance.

Android

Here, attribution is much more straightforward. Every install gives access to the ad ID, with no opt-in required. Raw data is instantly available via MMPs, offering full-funnel visibility with no postback delay. This makes it possible to activate real-time, granular optimization from the very first signals.

That said, changes may be coming. Privacy Sandbox is pushing Android toward a more privacy-focused model, and over time, it could reduce signal availability, bringing the platform closer to iOS’s restrictions.

Round 2: Geographic Distribution

iOS

With around 28% global market share, iOS may be the minority in terms of volume, but the distribution is far from uniform. The OS dominates in high-purchasing-power regions: 57% market share in the US, and strong presence in Japan, the UK, Scandinavia, and Australia (source: StatCounter – april 2025).

That makes iOS a strategic lever for premium campaigns or when targeting users likely to convert or subscribe.

Android

With nearly 72% global market share, Android clearly leads in volume. It’s the dominant OS in high-potential regions like India, Southeast Asia, and Latin America, major growth areas.

Its broad reach makes it a key channel for large-scale acquisition strategies, entering new markets, or quickly activating high volumes.

Round 3: User Cost & Revenue

iOS

Average CPI on iOS is higher, around $4.70 (Business of Apps, 2024). But this cost is offset by significantly higher user profitability.

90-day ARPU reaches $8.39 for subscription apps (vs. $1.54 on Android), and $0.77 for IAA models (vs. $0.35) (AppsFlyer, 2024). The App Store also leads in global revenue, generating $103.4B in 2024 compared to $46.7B on Google Play. iOS audiences spend more, convert better, and provide a solid framework for ROAS-focused or subscription-based strategies.

Android

CPI is lower, around $3.40, making Android a strong lever for scaling fast, testing creatives, and generating volume quickly.

On average, Android users generate less revenue, and the gap with iOS is still notable. But on key markets, in-app spend is rising fast. Between 2022 and 2024, in-app purchases grew by 28.5% in Brazil, 62.5% in Indonesia, and 85% in Mexico (State of Mobile Gaming 2025, Sensor Tower). These markets highlight the rise of mobile-first regions where Android monetization potential keeps growing year after year.

Round 4: Organic Visibility & ASO

iOS

ASO on iOS follows a well-defined structure with specific fields: title, subtitle, category, and a hidden keyword list. The long description doesn’t affect ranking but still plays a role in convincing users.

Visually, the App Store allows up to 10 screenshots and 3 preview videos, all visible directly in search results. This visibility can boost conversion rates , as long as Apple’s strict review rules are followed. These guidelines can slow down publication but help ensure consistency and quality across product pages.

Custom Product Pages (CPPs) offer the ability to tailor visuals and messaging by audience or campaign, a strong asset for UA strategies.

Android

Android takes a more flexible approach: most text fields (title, descriptions, category) are indexed, and keyword density directly impacts visibility.

The store allows up to 8 screenshots and 1 video, but these aren’t always displayed in search results, which can limit their influence on click-through rates. Android’s key strength is speed: with Google Play Experiments, A/B tests on visuals or text can be launched without a store update.

This flexibility is great for fast iteration, but it also comes with more variability. Store performance can fluctuate with algorithm changes or volume shifts, requiring close and constant monitoring to stay optimized.

Conclusion

There’s no clear winner between the two OS.

iOS remains the go-to platform for generating high user value, with audiences more likely to convert and spend. But this performance comes within a more rigid and closed ecosystem.

Android, on the other hand, is built for scale. Its open environment makes it easier to test, adjust, and optimize, but the value per user tends to be more variable, with lower average spend.

In reality, the best approach isn’t about choosing one or the other, it’s about combining both. By leveraging the strengths of each ecosystem, advertisers can build UA strategies that are not only effective, but sustainable and aligned with their goals.

NEWS

Article in relation

UA Digest #13: What’s new this month?

Discover our User Acquisition Digest, your monthly update on the latest trends and news in performance marketing! Adjust releases its “Mobile App Trends...

Published on 23 February 2026

Full-funnel: why it has become essential in performance…

For a long time, marketing performance was mainly about conversion. Generating purchases, measurable leads, or app installs was enough to steer acquisition strategies....

Published on 9 February 2026

Acquisition Battle #4: Branding Vs Performance

In acquisition, finding the right balance between branding and performance remains a central topic. Branding is often associated with awareness and long-term impact,...

Published on 27 January 2026