LifeTime Value (LTV): Definition, Calculation, and Strategies for Optimization

Introduction

LifeTime Value (LTV), or Customer Lifetime Value, is a key metric in mobile marketing that helps assess the average profit generated by a customer throughout their relationship with a business. Understanding and optimizing LTV is essential for advertisers and mobile marketing specialists looking to maximize the profitability of their campaigns. But how is this metric calculated, interpreted, and improved? This article explores these aspects in detail.

What Is LifeTime Value?

Definition

LifeTime Value (LTV) represents the financial value a customer brings to a business over the entire duration of their relationship. The longer a customer remains loyal and continues purchasing, the higher their LifeTime Value.

In other words, this metric answers the question: “How much revenue does a customer generate on average before they stop engaging with my business?”

A company with a high LifeTime Value relative to its Customer Acquisition Cost (CAC) is in a stronger position to achieve sustainable growth and profitability.

How Is LifeTime Value Calculated?

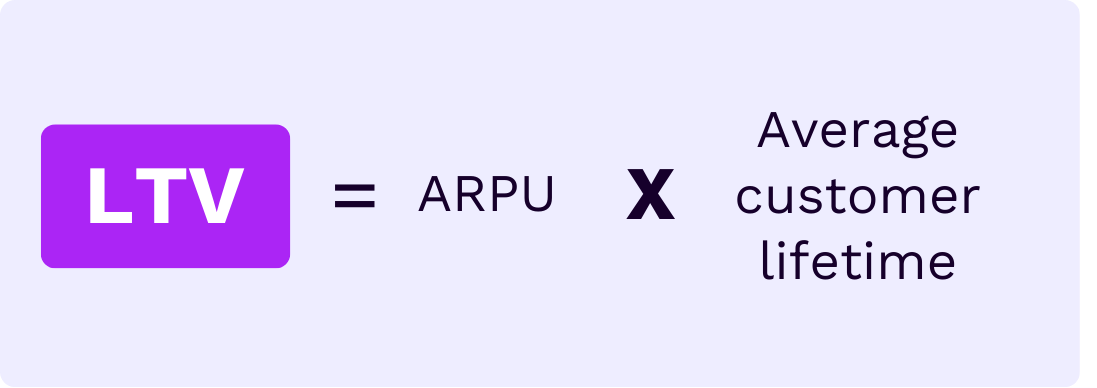

Several formulas can be used to calculate LifeTime Value, depending on the company’s business model. The most common formula is:

Where:

- ARPU (Average Revenue Per User): The average revenue generated by a user over a given period.

- Customer Lifetime: The average duration a customer remains active.

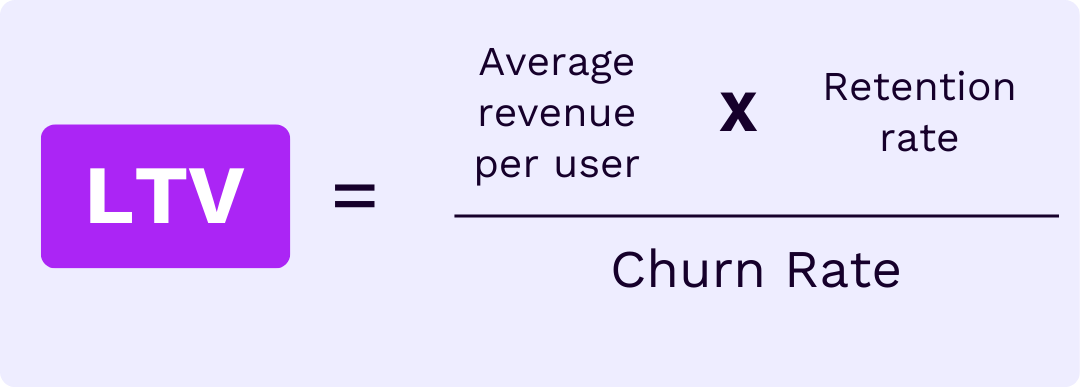

For subscription-based models, the formula can be refined by including margin and retention rate:

For example, if a user spends an average of €50 per month on your mobile app and remains subscribed for 12 months, their LifeTime Value would be:

LifeTime Value =50€×12=600€LTV = 50€ × 12 = 600€

A high LifeTime Value indicates that customers stay longer and spend more, while a low LifeTime Value may signal retention issues or inefficient monetization strategies.

LifeTime Value in Relation to Other Metrics

Customer Acquisition Cost (CAC)

CAC represents the average cost to acquire a customer. A business must ensure its LifeTime Value is significantly higher than its CAC to maintain profitability.

LifeTime Value/CAC Ratio = LifeTime Value ÷CACLTV / CAC Ratio = LifeTime Value ÷ CAC

A LTV/CAC ratio above 3 is generally recommended for sustainable growth.

Retention Rate

Retention rate measures user loyalty and directly impacts LifeTime Value. This metric should be analyzed alongside LifeTime Value, as it indicates how well the app aligns with its target market. A high retention rate signifies a smooth user experience and a product that resonates with its audience.

Churn Rate

Churn rate measures the percentage of customers leaving the business over a given period. Unlike retention rate, a high churn rate may indicate a poor product-market fit, a suboptimal user experience, or, in mobile games, excessive difficulty progressing to higher levels.

Why Is LifeTime Value a Key Metric in Mobile Marketing?

Better Decision-Making

LifeTime Value helps optimize marketing investments by identifying the most profitable user segments. These segments can be leveraged to create lookalike audiences for user acquisition campaigns.

Improved Forecasting With Predictive LifeTime Value (pLTV)

What Is pLTV?

Predictive LifeTime Value (pLTV) is a future estimate of LifeTime Value based on predictive models and past user behavior data. It helps prioritize the most effective acquisition channels.

How Is It Used?

It optimizes advertising campaigns by identifying users with the highest potential value, allowing marketing budgets to be allocated to the most profitable audiences through the most effective channels.

Increasing Customer Loyalty

A strong LifeTime Value depends on loyal customers, requiring effective engagement and retention strategies.

Driving Repeat Purchases

Repeat purchases directly increase LifeTime Value and ensure sustainable growth. E-commerce and gaming apps often use reward systems to encourage frequent user engagement.

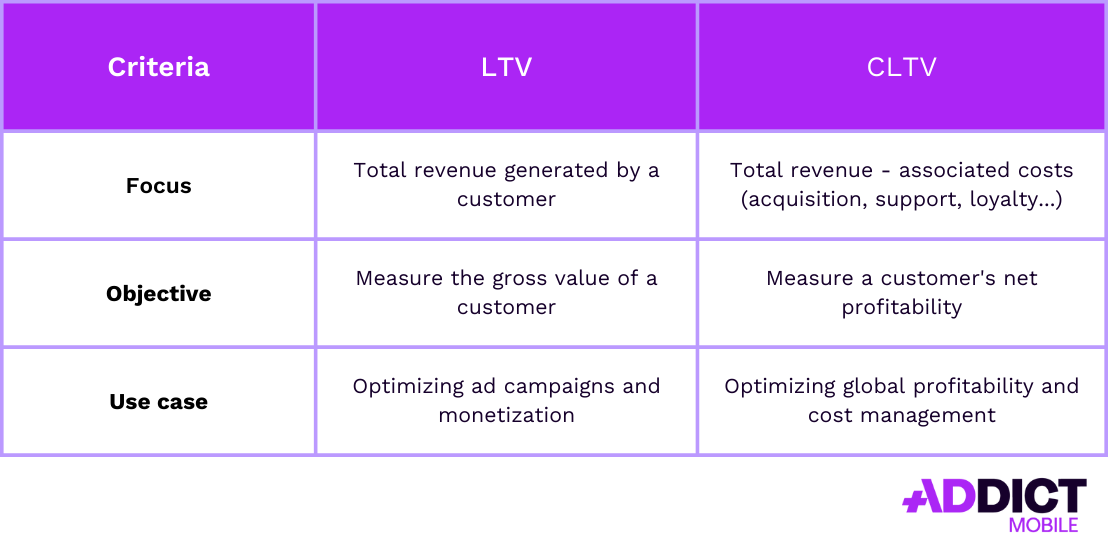

What Is CLTV?

Customer Lifetime Value (CLTV) represents the net value of a customer over their entire relationship with a business, factoring in acquisition, retention, and service costs. Unlike traditional LifeTime Value, which focuses solely on revenue, Customer LifeTime Value provides a more realistic view of customer profitability.

Differences between LTV and CLTV

How to Calculate CLTV?

A common formula is:

Customer LifeTime Value = (ARPU×GrossMargin×CustomerLifetime)−CACCLTV = (ARPU × Gross Margin × Customer Lifetime) – CAC

Where:

- Gross Margin (%) = (Revenue – Cost of Goods/Services) ÷ Revenue

- Customer Lifetime = 1 ÷ Churn Rate

🔹 Example : If a customer generates €100 in monthly revenue, stays active for 12 months, has a gross margin of 40%, and a CAC of €150:

Customer LifeTime Value =(100€×0.40×12)−150=330€CLTV = (100€ × 0.40 × 12) – 150 = 330€

This means the customer generates a net profit of €330 after acquisition costs.

Why Track Both Metrics?

- LTV estimates gross customer value and evaluates acquisition and monetization performance.

- CLTV determines actual profitability, considering retention and service costs.

💡 Combining LifeTime Value and CLTV helps refine acquisition budgets, improve retention, and optimize marketing ROI.

LTV vs CAC: Differences and Practical Use

Key Differences

- LTV: Measures a customer’s long-term profitability.

- CAC: Measures the cost to acquire a customer.

When to Use Each Metric?

- CAC: Useful for optimizing acquisition spend.

- LTV: Crucial for assessing long-term profitability

Why Track Both?

A business cannot focus solely on CAC or LifeTime Value, balancing acquisition and profitability is essential.

ARPU and LTV: Differences?

What Is ARPU?

Average Revenue Per User (ARPU) represents the average revenue generated per user over a given period.

Why Are These Metrics Complementary?

ARPU provides an instant revenue snapshot. LifeTime Value offers a long-term perspective on user value.

Strategies to Improve LifeTime Value

Optimized Customer Experience

High-Quality Customer Service

Excellent customer service provides personalized advice, helping users get the most from a product or service. This enhances user understanding and significantly reduces churn.

🔹 Example : A fitness app sending personalized tips based on user activity strengthens engagement and customer lifetime.

Seamless Purchase Experience

A frictionless user journey reduces churn. Simplified purchasing processes lower cart abandonment rates and improve retention.

Improved Onboarding

A well-designed onboarding process boosts early engagement, reducing churn and increasing retention rates.

Integrating LifeTime Value With Mobile Attribution Data

Connecting LTV to attribution data identifies the most profitable acquisition channels and optimizes budget allocation. Understanding which sources bring high-value users improves ad targeting, segmentation, and overall marketing ROI.

Offering Better Value for Money

Competitive offers enhance loyalty, encouraging users to spend more.

Launching Loyalty Programs

Rewards and exclusive benefits keep customers engaged over time.

Do not hesitate to contact with our teams

Addict can support you to improve your performance.

Conclusion

LifeTime Value is a key metric in mobile marketing, directly impacting the profitability of advertising campaigns. By optimizing LTV and aligning it with CAC, businesses can ensure sustainable growth and maximize ROI.