Customer Acquisition Cost (CAC): Definition, Key Concepts and Strategies in App Marketing

Introduction

Customer Acquisition Cost (CAC) is a key metric for evaluating the effectiveness of marketing campaigns. In app marketing, where competition is fierce, controlling CAC is essential to ensure profitability and sustainable growth for an application.

What is CAC?

Definition

CAC represents the average amount spent to acquire a new customer. It includes all marketing and sales expenses required for that acquisition. This metric considers the total resources and spending involved in attracting users and converting them into paying customers. It is an essential metric in app marketing.

Calculation Method

The standard formula is:

For example, if a company spends €50,000 on marketing and acquires 1,000 customers, the Customer Acquisition Cost is €50.

Costs to Include

Several types of expenses must be included in the calculation of Customer Acquisition Cost. These costs include:

- Advertising spend across all sources (Google Ads, Meta, TikTok, etc.)

- Salaries of marketing and sales teams

- Tools and software (CRM, analytics, automation)

- Content creation costs (videos, visuals, landing pages, graphic skills)

- Agency or external consultant fees

Why is it Important in App Marketing?

Customer Acquisition Cost is a crucial KPI in app marketing. It enables marketers to evaluate the effectiveness of marketing efforts and optimize them to avoid unnecessary spending.

Measure Campaign Performance

Accurate tracking of Customer Acquisition Cost helps identify the most profitable campaigns and eliminate those that are not, thereby optimizing resources. It also allows marketers to assess whether a channel is becoming unprofitable.

Indeed, if CAC exceeds LTV during a campaign, each new user acquired results in a loss. Conversely, if LTV is higher, the campaign generates profits.

Identify the Most Effective Channels

By calculating CAC per acquisition source (TikTok, Meta, AdNetwork…), marketers can evaluate profitability by channel and gain a detailed view of each one’s effectiveness. This allows UA teams to prioritize high-performing channels and cut non-profitable campaigns to optimize media mix.

Optimize and Forecast Growth Budget

By investing in the most profitable channels, you can optimize your budget to ensure that every euro spent yields more. Calculating Customer Acquisition Cost also allows you to model future acquisition scenarios and determine the point of scalability—when CAC begins to rise too much relative to spend. This allows for continuous budget optimization and the ability to anticipate potential issues in advertising investment.

Drive More Accurate ROI

Lowering Customer Acquisition Cost while maintaining the quality of acquired users improves the overall Return on Investment (ROI) of your campaigns. Keeping CAC low makes it easier to justify channel-specific investments to the finance team.

Identify Friction Points in the Funnel

A rise in the KPI can indicate problems in the user journey, requiring optimization of the conversion funnel. If CAC increases, it’s not always due to higher media costs—other factors may be at play:

- Clicks that don’t convert into installs (CTR → install)

Possible friction: unoptimized landing page, weak app store page, poor app rating - Installs that don’t lead to activation (install → sign-up or first session)

Possible friction: onboarding too long, app crashes, unengaging first screen - Activations without monetization (sign-up without purchase, subscription, etc.)

Possible friction: no incentive, poorly placed paywall, unclear offer, low perceived value - Rapid uninstalls or drop-offs

Possible friction: misaligned expectations, confusing UX, app too heavy, misleading ad promise

Compare User Cohorts

Comparing Customer Acquisition Cost and LTV by cohort allows you to better understand which campaigns bring in the most engaged and loyal users—and to base decisions on sustainable user profiles.

What is a Good CAC?

A good CAC depends on the industry and customer LTV. Generally, an LTV/Customer Acquisition Cost ratio of 3:1 is considered healthy. This means that the value generated by a customer is three times higher than the cost of acquiring them.

A Good CAC Is One That’s Lower Than LTV

💡 Golden Rule: LTV > CAC

That’s the foundation. If CAC is lower than the user’s Lifetime Value (LTV), the campaign is profitable ✅

- If CAC = €5 and LTV = €10 → you gain €5 per user = 👌

- If CAC = €10 and LTV = €5 → you lose €5 per user = ❌

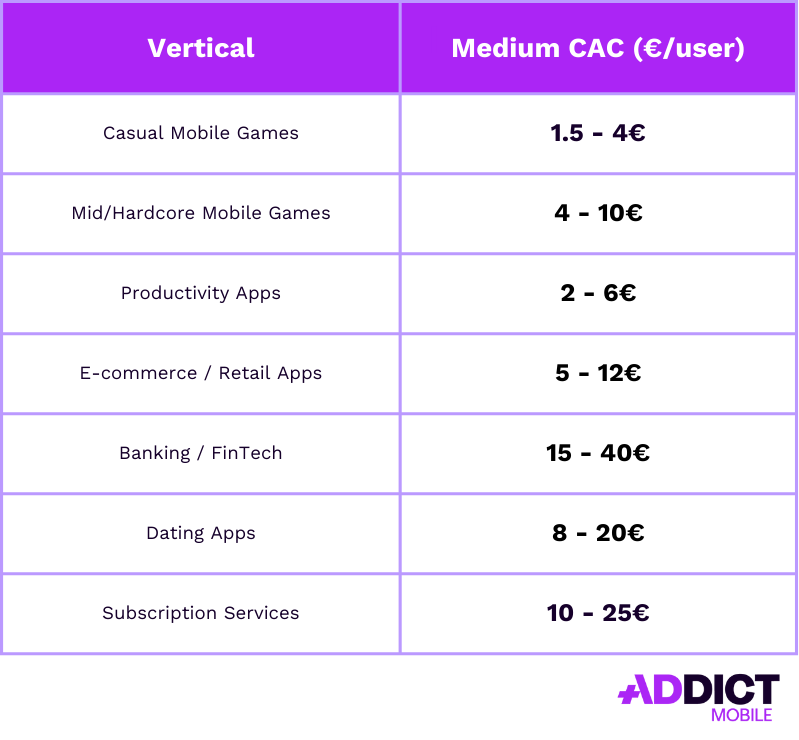

Average KPI Benchmarks by App Vertical

Here are some average order of magnitude figures by sector in the app universe (source: Adjust, Appsflyer, Business of Apps):

💡 Strategy should also be adapted by region. CAC tends to be higher in the U.S. than in Latin America or APAC regions.

A “Good” CAC Is Also One Managed at Every Funnel Stage

For example:

- Impression → Click (CPM / CTR)

- Click → Install (CPI)

- Install → Activation / Sign-up

- Activation → Purchase / Subscription (CPA)

👉 A good Customer Acquisition Cost often results from a well-optimized funnel, not just good media buying.

Customer Acquisition Cost Depends on the Business Model

Depending on your app type, your CAC tolerance and strategies may differ:

- Freemium apps → Requires low KPI, as monetization is indirect (ads, upgrades…)

- Subscription apps → Can afford higher KPI (e.g., CAC = €15; if subscription = €5/month and user stays 6 months → you’re profitable)

- E-commerce apps → CAC is spread over Customer Lifetime Value (repeat purchases, upsell…), so higher Customer Acquisition Cost may be acceptable

Which Metrics Should Be Paired with CAC?

- LTV (Lifetime Value): Total value a customer brings to the business over their lifecycle

- Gross Margin: Determines whether CAC is covered by your profit margin

- ROAS (Return on Ad Spend): Measures ad campaign efficiency

- AOV (Average Order Value): Indicates transaction-level profitability

- CPA (Cost Per Acquisition): Useful to compare acquisition cost per specific action

- Retention Rate: High CAC is worthless if users churn immediately

Pairing CAC with these metrics offers a holistic view of marketing performance, enabling smarter decision-making.

Which Strategies Help Reduce Customer Acquisiton Cost?

A high CAC isn’t always irreversible. Several best practices help reduce unnecessary spend:

- Conversion Rate Optimization (CRO): A/B test landing pages, calls-to-action, and forms to improve conversion rates

- Invest in the best-performing channels: Analyze acquisition performance and focus efforts where ROI is highest

- Referral and loyalty programs: Encourage existing users to refer others to reduce acquisition cost

- Improve the user experience: A seamless, enjoyable UX boosts conversion and loyalty, lowering the KPI

- Target high-value customers: Identify the most profitable segments and build lookalike audiences for campaigns

- Invest in predictive marketing: Anticipate user behavior and tailor campaigns accordingly

- Leverage CRM data for targeted campaigns: Use CRM segmentation to run more efficient and relevant campaigns

Key Takeaways

- Customer Acquisition Cost is a fundamental metric for evaluating marketing efficiency

- It should be analyzed alongside LTV, ROAS, and retention rate

- Targeted strategies can help reduce costs while improving user quality

Conclusion

Mastering Customer Acquisition Cost is essential to ensure the profitability and growth of a mobile app. By combining deep CAC analysis with targeted optimization strategies, businesses can enhance their marketing performance and successfully reach their business goals.