5 acquisition strategies retailers can’t miss in 2026

In 2026, retailers operate in an environment where attracting qualified shoppers, controlling costs, and boosting conversion are key challenges. Whether acquisition happens on the web, in-app, or across both, performance depends on the ability to activate the right levers at the right moment in an increasingly fragmented purchasing journey.

In this context, building an effective strategy means finding the right mix between channels, creatives, and commercial moments, while adapting to a highly competitive landscape.

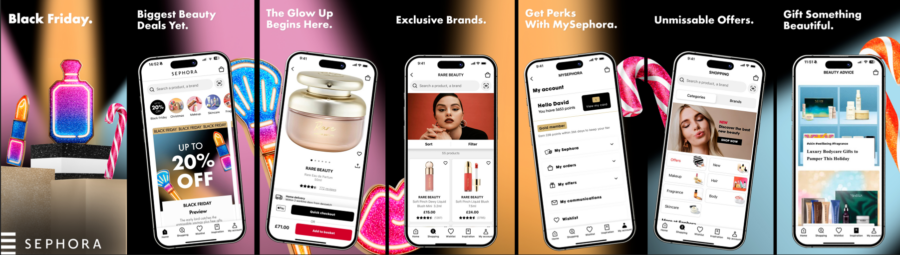

Our experience working with retailers such as Sephora, Decathlon, LG, and La Redoute highlights the levers that truly drive acquisition performance in retail. Here are 5 retail acquisition strategies that will shape the difference in 2026.

Key takeaways

- Web and app complement each other: one captures intent, the other maximizes value.

- Diversifying channels helps stabilize volumes and reduce cost fluctuations.

- A stable creative foundation combined with continuous refreshes leads to long-term performance.

- Peak periods don’t happen by chance: they require preparation and tailored messaging.

- Performance management means understanding value, not just ROAS. Cohorts, segmentation, and period-based objectives are essential.

1. Finding the right balance between Web and App

In retail acquisition strategies, web and app don’t play the same role, yet they’re not in competition. The most effective approaches rely on how well both environments complement each other.

Truly complementary roles

The web is often the first entry point. It allows retailers to quickly reach a large volume of shoppers, capture immediate intent, and easily test new messages. Its accessibility makes it a strong lever for upper–mid funnel phases or fast conversions.

The app, on the other hand, is becoming increasingly important in the mix. Once users are engaged, it generally delivers higher value: stronger retention, a more complete purchase journey, increased purchase frequency, and clearer visibility on post-purchase actions. Many retailers even observe that app revenue grows faster than the share of budget allocated to app acquisition.

The importance of a smooth Web-to-App journey

The goal isn’t to choose between web and app, but to use each one where it delivers the most value. A seamless web-to-app transition through smart banners, deep links, or incentives can turn a one-off visit into a long-term relationship without adding friction.

Finally, the right balance depends on market maturity and local behaviors. In some countries, mobile commerce is well established and, the app plays a central role. In others, the web remains the main touchpoint. Adapting the mix is often the first driver of performance.

2. Diversifying channels to stabilize volumes and costs

Relying on a single network makes performance more volatile: CPM fluctuations, dependence on one algorithm, increased competition. A well-structured mix secures volumes and smooths cost variations. The goal isn’t to activate every platform, but to use each one where it delivers the most value.

Understanding the strengths of each platform

- Google (UAC / Search): a cornerstone for capturing intent and securing qualified volume. A reliable channel to reach shoppers already in active search mode and convert efficiently.

- Meta (Facebook / Instagram): combines reach, targeting, and performance. It plays a key role throughout the entire funnel, with dynamic formats such as DPA that perform particularly well on high-intent visitors.

- TikTok: brings incremental reach and a strong creative playground to engage audiences less responsive to traditional ad codes and to test new concepts.

- Snapchat: a tactical and highly relevant channel depending on the market (France, US, Middle East), especially effective among 18–34 year-olds with competitive costs.

Aligning channels with the right objectives

Each platform plays a different role in the purchasing journey. An effective mix relies on three levels:

- Acquisition: Google, Meta prospecting, TikTok for broader reach.

- Retargeting: Meta, particularly through DPA.

- Re-engagement: Meta or Google depending on available signals.

3. Building a creative approach tailored to retail

In a highly competitive environment like retail, creatives are one of the main performance drivers. Shoppers compare quickly, scroll quickly, and lose interest just as fast. Maintaining efficiency requires a structured approach with clear angles and continuous refreshes.

Building a stable creative foundation

An effective strategy starts with a consistent set of generic visuals: simple, readable creatives that highlight the brand universe and key products.

This foundation:

- Ensures continuity in algorithm learning,

- Reduces performance fluctuations when campaigns change,

- Provides consistent visual cues throughout the year.

Commercial peak periods, on the other hand, require tailored creatives, something we’ll cover in the next section.

Regularly refreshing creative angles

Around this foundation, ongoing creative testing is essential to avoid ad fatigue and capture different buying motivations. Several angles consistently perform well in retail:

- Best-sellers to reduce hesitation,

- UGC and customer reviews to reinforce social proof,

- Short messages and product-focused visuals, which are key in a low-attention environment.

Testing these variations regularly helps identify the combinations that perform best across audiences.

Ensuring alignment between paid and organic

Creative performance also depends on overall consistency. Custom product pages aligned with organic visuals strengthen messaging, streamline the user journey, and improve understanding of the offer.

4. Leveraging key commercial moments with dedicated strategies

Peak periods play a decisive role in retail performance. They’re not just promotional events, they concentrate buyer attention into very short windows where competition intensifies and every lever matters.

Preparing activations ahead of time

Solid preparation is essential: adapting creatives, planning budgets, optimizing landings, and defining the most relevant environment for that specific moment. This anticipation avoids last-minute adjustments and ensures a more consistent execution when purchase intent is at its highest.

Adapting creative angles to high-intent periods

During peak moments, shoppers are already more receptive. Angles focused on best-sellers, urgency, or product listings tend to perform particularly well. Clear, direct, product-driven messages help decision-making at a time when everything moves quickly.

Capitalizing on underestimated opportunities

Beyond the classic seasonal peaks, certain periods like Q5 offer strong potential: media costs drop while demand picks up again. When fully leveraged, these windows represent a strategic opportunity that is often overlooked.

5. Measuring retail performance with the right indicators

Driving retail performance requires a more nuanced approach than looking at immediate ROAS. To optimize effectively, you need to go beyond the instant conversion.

Analyzing the right signals depending on Web or App

On the web, decisions happen fast: add-to-cart, product views, scroll depth… These early KPIs help assess traffic quality from the very first interactions.

In the app, post-install data provides a richer view: activation, usage patterns, frequency… It allows you to anticipate a user’s potential value rather than focusing only on the immediate conversion.

Measuring real value through cohort analysis

Cohort analysis reveals how value evolves over time: repeat purchases, frequency, average basket, and more. These signals make it possible to allocate budgets based on actual value rather than short-term cost.

Distinguishing new customers from reactivation

A new customer does not behave like a reactivated one: intent, costs, frequency, and average basket are often very different. Mixing both profiles makes the analysis unclear. Segmenting campaigns ensures more accurate steering based on the intended objective.

Aligning KPIs with peak periods

Every peak moment comes with its own objectives: revenue growth, new customer acquisition, category performance…

For example, during Black Friday, the priority is often revenue and maintaining a target ROAS.

On the other hand, on Mother’s Day or more targeted moments, the objective might be to acquire new customers or push a specific category. KPIs should reflect the business goal of the moment.

Conclusion

In 2026, retail performance relies on a more structured approach to acquisition: combining web and app, diversifying channels, strengthening the creative strategy, preparing key commercial moments, and using the right indicators. Retailers able to bring these levers together in a consistent way will gain in conversion, profitability, and customer value.

Q&A

By combining multiple channels (Google, Meta, TikTok…), optimizing creatives, and adapting the strategy to key commercial moments.

The web captures immediate intent, while the app drives higher long-term value. The best results come from a complementary approach.

Early KPIs, cohort analysis, new customers vs reactivation, and KPIs aligned with each peak moment.

Best-sellers, UGC, customer reviews, and short product-focused visuals, supported by a stable creative foundation.

To stabilize volumes, reduce cost fluctuations, and reach complementary audiences depending on the platform.

By planning creatives, budgets, and messaging in advance, and aligning KPIs with the actual business objective (revenue, new customers, category push).

NEWS

Article in relation

Acquisition Battle #4: Branding Vs Performance

In user acquisition, finding the right balance between branding and performance remains a central topic. Branding is often associated with awareness and long-term...

Published on 27 January 2026

UA Digest #12 : What’s new this month?

Discover our User Acquisition Digest, your monthly update on the latest trends and news in performance marketing! AppsFlyer: what 2025 data already signals...

Published on 27 January 2026

Better performance starts with structured retail campaigns

In 2026, retail marketing is evolving in a more constrained environment. Acquisition costs are rising, and e-commerce journeys are increasingly fragmented between website...

Published on 15 January 2026