Acquisition Battle #3: App Vs Web

In mobile acquisition, choosing whether to run ads on the web or in-app may seem straightforward. Yet, the two don’t always serve the same objectives.

On one side, you’re driving installs and unlocking rich post-install data. On the other hand, you’re generating sessions instantly and getting conversions faster.

When it comes to tracking, profitability, retention, or flexibility, both approaches diverge, while still overlapping on certain strategic challenges.

So, App vs Web: what are the strengths and limitations of each model in acquisition? Let’s dive into the battle.

Key takeaways

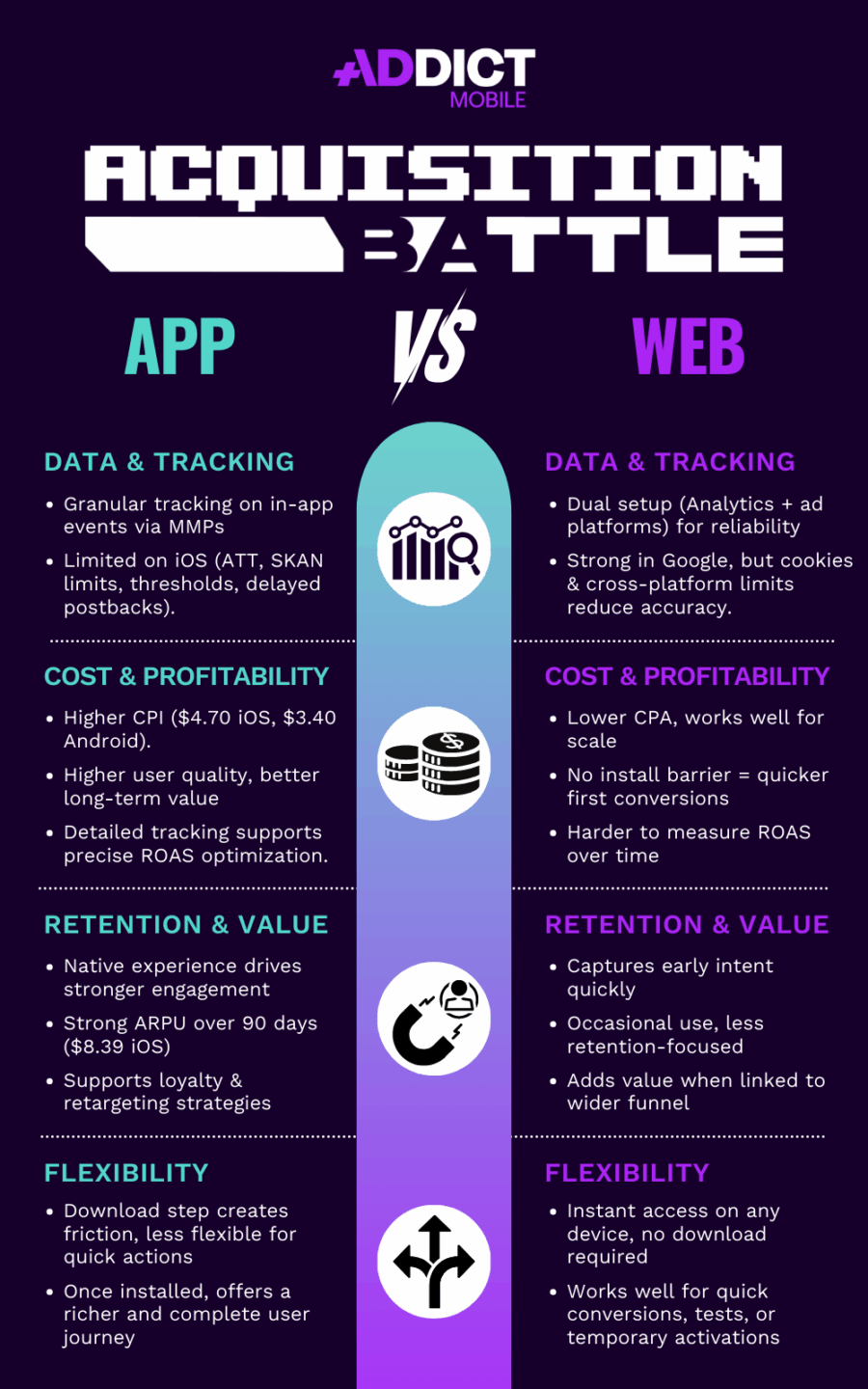

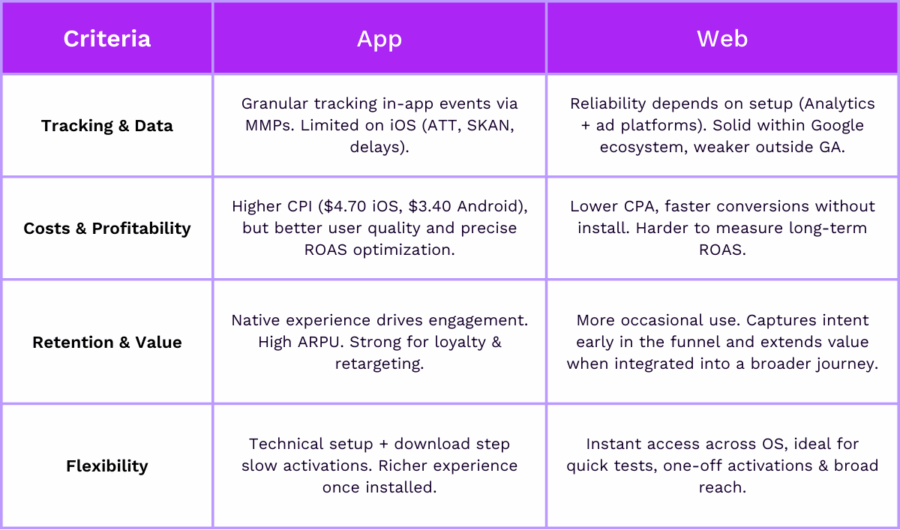

- Data & Tracking: App = granular insights via MMPs, with iOS constraints (ATT, SKAN). Web = depends on setup (Analytics + ad platforms), more reliable within Google’s ecosystem.

- Cost & Profitability: App = higher CPIs but stronger user quality and long-term value. Web = lower CPAs, faster conversions, harder to measure ROAS over time.

- Retention & Value: App = loyalty and retargeting, higher ARPU. Web = more occasional use, captures intent early, strong entry point.

- Flexibility: App = download barrier, but richer experience once installed. Web = instant access on any OS, ideal for reach and quick tests.

Round 1: Tracking and Data Reliability

App

App tracking relies on MMPs like Adjust or AppsFlyer. They provide objective, multi-source attribution based on shared rules and granular visibility on in-app events (sign-up, purchase, subscription…). That level of detail is essential to manage performance beyond the install and to run proper user cohort evolution.

However, the ecosystem is still constrained, especially on iOS. ATT limits access to IDFA, and SKAN tightens data access further with deferred postbacks, privacy thresholds, and standardized schemas. This narrows the analysis, particularly on small volumes or campaigns optimized for deeper-funnel conversions.

Web

On the web, tracking quality depends above all on the setup. A dual tracking approach is often recommended: on one side via the analytics tool (such as Google Analytics 4), and on the other via the ad platforms themselves (tags, pixels). Google Analytics 4 has been a real step forward, with more precise event tracking and better cross-device measurement. Properly configured, it provides reliable data across a large part of the user journey.

But this effectiveness remains closely tied to the Google ecosystem. As soon as you step outside it, especially on social platforms like Meta, tracking becomes less certain and complicates budget attribution decisions. Data is often undercounted and needs to be reconciled with figures from the advertising platforms. Third-party cookie limits and private browsing further complicate performance readouts.

Round 2: Acquisition Costs and Profitability

App

On app, the cost per install is high: $4.70 on iOS and $3.40 on Android (Business of Apps, 2024). But this investment comes with higher user quality from the first conversion, with stronger ARPU, especially for freemium, subscription, or in-app e-commerce models.

The granularity of tracking makes it possible to work with advanced conversion goals and optimize ROAS with greater precision.

Web

On web, CPA is often lower, particularly for large-scale campaigns or in regions where media costs are lower (India, LATAM, SEA). The absence of an installation step reduces friction, which often leads to higher initial click-through and conversion rates.

The web is therefore well suited to volume- or awareness-driven campaigns. However, while optimization levers are similar to those on app, the limited relevance of cohort models makes ROAS estimation more difficult. If the purchase does not happen quickly, the analytics tool may fail to attribute the conversion correctly.

Round 3: Retention & Long-Term Potential

App

Apps make it possible to build user value over time. A native experience, richer user flows, and post-install events make it easier to analyze behavior and optimize usage. Subscription or in-app e-commerce models deliver strong long-term performance, with a 90-day ARPU reaching $8.39 on iOS (AppsFlyer, 2024).

The app also creates a favorable environment for loyalty, with the option to extend engagement through retargeting audiences. But for this strategy to work, you need volume, a well-activated product, and the time required for value to grow.

Web

The web operates on a different logic, less about retention, but no less effective. Usage is often more occasional, yet it captures intent very early in the funnel, making it a strategic entry point.

When integrated into a broader ecosystem (form, content, redirection to app, email follow-up, or retargeting), the web can extend the relationship and generate value beyond the first visit. It’s not a retention channel in itself, but it can feed loyalty through other touchpoints.

Round 4: Flexibility

App

The app environment comes with a key but restrictive step: convincing the user to download it. This barrier makes the channel less flexible for short funnels or discovery campaigns, where initial intent is still low.

On the other hand, once installed, the app offers a smoother, richer native experience with complete journeys (sign-up, purchase, subscription).

Web

Mobile web, accessible without download and compatible with all OS, stands out for its flexibility and accessibility. It makes it easier to reach a wide audience and to launch one-off activations, creative tests, or media-driven highlights.

This universal accessibility makes the web a responsive and adaptable lever, even if the user journeys remain more limited compared to an app.

Conclusion: Two Channels, Two Complementary Logics

There’s no clear winner between the app and the web. Each channel addresses different challenges, depending on the funnel stage, objectives, or journey structure.

The app provides deeper data, advanced post-install optimization levers, and a long-term monetization strategy. But it also comes with an initial barrier and requires a more gradual approach to building profitability.

The web, on the other hand, brings valuable agility: immediate accessibility, broad reach, fast testing, and a key role at the top of the funnel. Less suited to direct retention, but highly effective when integrated into a broader journey.

Rather than choosing one over the other, the right move is to activate the right lever at the right time, and combine their strengths to build a UA strategy that is coherent, efficient, and aligned with real business goals.

NEWS

Article in relation

Google Ads 2026: 4 Tips to Adapt to…

Google Ads remains a core pillar of performance marketing for many advertisers. The platform drives volume, captures strong intent, and directly contributes to...

Published on 3 March 2026

UA Digest #13: What’s new this month?

Discover our User Acquisition Digest, your monthly update on the latest trends and news in performance marketing! Adjust releases its “Mobile App Trends...

Published on 23 February 2026

Full-funnel: why it has become essential in performance…

For a long time, marketing performance was mainly about conversion. Generating purchases, measurable leads, or app installs was enough to steer acquisition strategies....

Published on 9 February 2026