UA Digest #9 : What’s new this month?

Discover our User Acquisition Digest, your monthly update on the latest trends and news in mobile marketing and user acquisition!

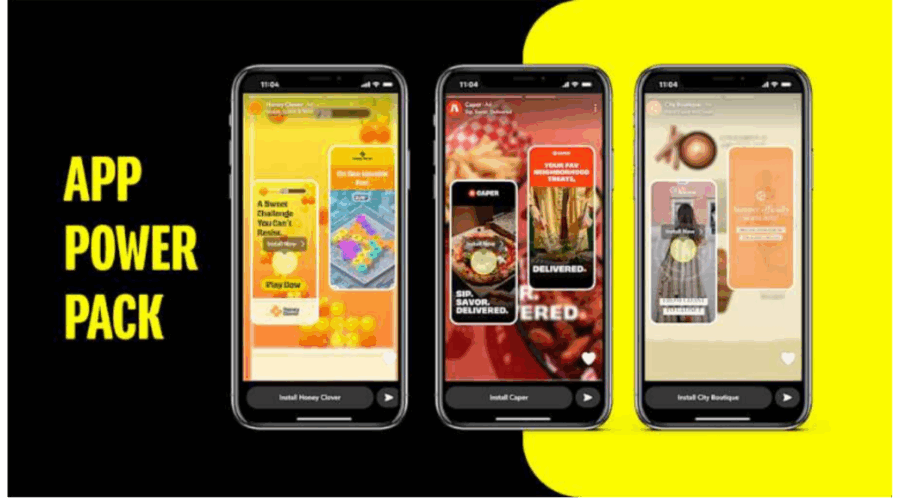

Snap launches “App Power Pack” to boost app campaigns

Snapchat is rolling out App Power Pack, a suite of features designed to improve app install campaign performance. Compatible with both SKAN and non-SKAN, the pack aims to make campaigns more efficient and engaging. According to Snap, advertisers already using it are seeing +25% more installs.

Here’s what’s new:

- Expanded Sponsored Snaps: Already available in chat, they’re now accessible through the ad auction and can be leveraged for app campaigns. In Q2 2025, they delivered +18% more unique conversions.

- App End Cards: Automatically add visuals from the App Store at the end of an ad, allowing users to immediately see what the app looks like before downloading.

- Playables (alpha): Interactive mini-versions of an app or game that users can test directly within Snapchat, offering a preview of the experience and driving stronger engagement.

- Improved tCPA: Advertisers can now set a target cost per acquisition and an overall budget, while the algorithm automatically adjusts delivery to hit performance goals.

With this launch, Snap strengthens its mobile offer by combining cost optimization, immersive formats, and better app visibility.

Meta shares holiday tips: AI, omnichannel, and content creators

Meta has released its recommendations for 2025 holiday campaigns, highlighting three strategic levers to maximize ad performance.

- AI and automation: Meta encourages the use of Advantage+ and its AI models (Lattice, Andromeda) to automatically generate ad variations tailored to seasonality. According to the platform, these models have already delivered measurable results, with up to +6% more conversions and higher ad quality scores.

- Omnichannel approach: With Conversions API, in-store sales can be connected to digital campaigns. Meta reports that omnichannel campaigns achieve up to 32% lower cost per incremental offline conversion and +21% ROAS compared to digital-only campaigns. It also recommends extending campaigns beyond Christmas, when CPMs drop but engagement remains strong.

- Power of creators: Creator-driven content, such as unboxings, seasonal challenges, and gift-focused Reels, plays a central role. Meta notes that 80% of social users have purchased a product discovered through a creator.

A strong reminder of the importance of mobile and short formats in holiday campaigns, with AI and creators as key drivers of efficiency.

Non-gaming apps surpass games in revenue for the first time

According to a report from Sensor Tower and Business of Apps, in Q2 2025, in-app purchase (IAP) revenue from non-gaming apps reached $20.9 billion, overtaking mobile games for the first time.

Key takeaways:

- Since early 2023, gaming revenues have remained flat, while non-gaming apps have grown by +65.8% over the same period.

- Top-performing apps are driving growth through subscriptions, in-app commerce, and non-gaming IAPs.

- Consumers are increasingly embracing free trial / monthly subscription models. Sectors such as video streaming, productivity tools, and AI-based apps are particularly benefiting.

Google expands Web to App Connect to more campaign types

Google is extending Web to App Connect, the tool that links web journeys to in-app conversions, to additional campaign formats. Since September 5, 2025, it now works not only for Search and Shopping campaigns but also for YouTube Ads, Performance Max, Hotel Ads, and Demand Gen.

Key updates:

- Track app installs from web campaigns directly in Google Ads (for Search & Shopping), without needing third-party attribution tools.

- Unified interface: a new conversion setup page that consolidates both web and app events, along with a combined performance card (web + app) on the Google Ads homepage.

- Deep linking for YouTube Ads: if the app is installed, users are redirected to a specific in-app destination; otherwise, they’re taken to the mobile site.

These updates provide a more integrated view of the user journey, from web ads to the app, while simplifying reporting.

Singular : Key UA mobile trends for Q3 – Q4 2025

According to Singular, several signals indicate that the mobile acquisition landscape is evolving, not just in terms of volume, but also in the sophistication of optimization.

- UA spend is up ~45% YoY, with the strongest growth seen in APAC, LATAM, and parts of Europe.

- CTR is rising, particularly on iOS and in gaming, but more clicks don’t always mean more value, efficiency is defined further down the funnel.

- CPI is increasing, but so are installs. This suggests that higher media costs can remain sustainable if LTV and retention stay strong.

- CTV and rewarded ads are gaining ground as performance drivers, provided audience quality and authenticity are safeguarded.

- Marketers’ top priorities: testing channel incrementality and doubling down on creativity, adapting formats and messaging to maximize efficiency.

Full details and additional insights are available in Singular’s article and webinar.

NEWS

Article in relation

Cheat Sheet #3: Everything You Need to Know…

Q5 is the post-holiday “bonus” period running from December 26 to mid-January, a unique opportunity for advertisers to keep momentum after the holiday...

Published on 5 November 2025

UA Digest #10 : What’s new this month?

Discover our User Acquisition Digest, your monthly update on the latest trends and news in mobile marketing and user acquisition! Meta Andromeda: the...

Published on 28 October 2025

Meta Ads vs TikTok Ads: Which Platform Should…

In 2025, social ads have become a must for capturing attention and driving performance. When it comes to two major players, Tiktok ads...

Published on 20 October 2025